Scotland should not have any historic debt?

Some serious (and less serious) people on the Yesser side attempt to argue that Scotland should not take a population share of UK debt liabilities. This is based on a strange assumption that debt seems to start in 1980.

As GERS data goes back to this date it provides an interesting starting point. It also coincides with the North Sea oil boom when for a relatively brief but important period Scotland contributed substantially more to the UK Exchequer than it received in spending. This has been comprehensively discussed by Kevin Hague in his blog

But let’s accept the "the world started in 1980" claim for the purposes of this argument. The argument then goes that had Scotland held on to their surplus from the 1980s it would not have any debt. However I’ve calculated the effect of reinvesting the GERS surplus at 4% (a Business for Scotland assumption) to project the size of an oil fund. This shows that the effect of higher public spending in Scotland negates any effect of a "start the clock in 1980" surplus.

Now let’s deal with the start the clock in 1980 concept. You just have to ask the question why start there? Why not 15 years ago for example where GERS shows that on a per head basis Scotland has only had three years where it had a lower deficit or better surplus than the UK.

My own view is that you should start in 1888.

That was the year that the Goschen formula started, which was the forerunner to Barnett. It guaranteed a level of public spending for Scotland which turned out to be far greater than its population share. Something that the the

Of course whilst we know that Scottish spending was higher than the UK on a population basis (and rightly so due to our relatively sparse population which makes providing services more expensive) we don't have equivalent data on income. However it is reasonable to assume that the Scottish contribution to taxation would be broadly in line with its population share largely because that’s what the GERS data shows if you exclude oil (a very generous assumption based on current data)

On that basis from 1888 up to the advent of North Sea oil Scotland contributed a population share on taxation but received a higher than population share of public spending. It therefore received a subsidy from the UK, again which was reasonable due to the wider dispersal of the Scottish population.

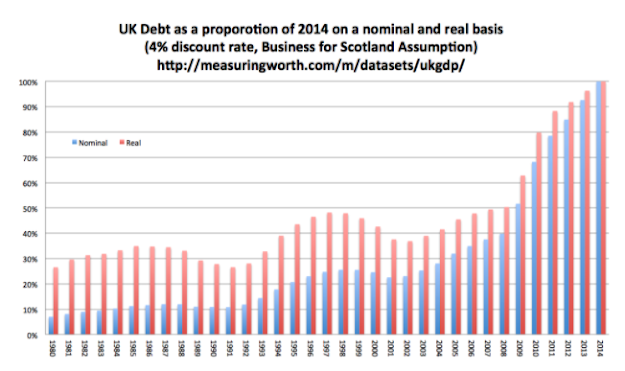

You could argue that 1980 is a reasonable date to select as 93% of current debt was accumulated from that date. On a nominal basis that is the case but on real basis (discounting at the 4% Business for Scotland assumption I used earlier) that figure changes to 73%. More to the point when one considers the shape of the development of debt on a real basis the actual substantive rise in real debt started in 2002. In which case that year would be a suitable starting point, again that’s not a position that favours Scotland.

Scotland as part of the UK has historic debt and a population share is a perfectly reasonable allocation for the country under independence, indeed if offered it on a population share basis I would argue that is very generous to us.

UPDATE July 2020

I've noticed for a few months now that Business for Scotland are now trying to claim that Scotland shouldn't be responsible for UK debt because its historic contribution to Scottish debt.

That is, the author has done some calculations and came to some conclusions, but he's refusing to actually publish them. Believe me I've tried to get them, he refuses to answer questions or even post my questions in his comments section.

Richard Murphy has joined in this game. Having burnt his bridges with the nationalist community with his devastating critique of the SNP's currency policy, was evidently keen to make amends with the nationalist community. I've been commenting in his blog and he's at least included the comments and replied to them (which shouldn't be mistaken for engaging with them because it's a horror show of deflection from him).

What better way to get back in with the nationalist community than to pretend Scots won't have to pay for debt. As I said I've been active on his comments section trying to extract his analysis from him, but he doesn't seem very interested in backing up his conclusions or data.

I gave him three critiques which I noted in his comments section, he deflected all of them.

"1 Political error

You cite yourself the UK Treasury announcement that rUK is taking on all UK debt, and the second clause to that statement that the Scottish Government will be taking on a debt agreement with the United Kingdom at the point of independence. You claim then that "the sum would not be due" which would be the case if the UK were negligent enough to pass an Act of Parliament creating a Free Scotland state which did not include a debt agreement.

So you can make your case that Scotland wouldn't have any debt but it would be based entirely on UDI (which it seems now you reject) or on the UK acting entirely against its own interest, in which case why not argue that the UK will not only agree no debt with Scotland but it will also agree a leaving gift of £1 million for every Scot. It sounds ridiculous, that's because like your case it is.

2 Data errors

The data which you have 'analysed' is entirely incomplete. It starts at 1980 and ends at 2014. You provide no explanation or justification for either despite the fact that up to date data is available and additional pre 1980s data can be created. The fact that the Scottish Government have not calculated beyond this date is telling in itself. So if you want a credible case can you explain why you can reach a conclusion based on the world starting in 1980 and ending in 2014?

3 Contradictory arguments

Your case is that Scotland would have credible case to argue that Scotland would not have to take a population share of debt due to your flawed analysis of history. However even for that flawed analysis to hold you would need to start with Scotland in 1980 inheriting a population share of UK debt. That's a self defeating argument because Scotland's share of UK debt in 1980 should also be based on historical balances. "

I thought it would therefore be useful to detail the calculations which I've eluded to.

The 2020 debt model

Scotland starts in 1980 as an independent state. It takes a share of UK debt as its historic debt at that time.

Then we look at SNAP/GERS for the net fiscal balance of Scotland in the UK. However now that Scotland has its own debt there is no need to pay for the UK debt costs, so these have to be extracted. This is simple enough as the UK debt interest payments are a matter of historical record and they are allocated in both GERS and SNAP as a population share.

This gives us a net fiscal balance for Scotland without debt. We now need to add in the cost of Scottish debt. For that we can use the debt allocation taken and multiply it by the 12 month UK gilt spot rate plus. haircut for the higher cost of debt which Scotland would face, as Scotland could not expect to borrow at UK rates. Additionally if Scotland was able to invest (say because its debt turned into a surplus then it can receive a (modelled) risk free return above RPI/CPI.

This then lets you project the Scottish fiscal position across a range of scenarios.

The key variables are the initial debt share, see below. 1 showing a population share (which Murphy and Business for Scotland must by definition reject as too small), a 2 times population share and a 3 times population share (in line with the current deficit and Scotland's contribution to the UK deficit when oil is not included).

The chart tells you everything you need to know.

1. Starting in 1980 is the best and ideal starting point for an Independent Scotland's finances.

2. No matter which position you are looking at Scotland's finances have been on a downward trend since 2000.

3 That downward trend has been sharp and hard since 2014 (when Murphy stops some of his analysis).

4 The analysis is VERY sensitive to that initial starting assumption of Scottish debt in 1980, the other assumptions about excess risk free return and haircuts are much more marginal).

Anyone doing this kind of model would spot point 4 very quickly.

This is a problem for Murphy. He either has done the work and doesn't want to show his workings (because it's self defeating) or he hasn't done the work and doesn't know.

Either way it's not a good look.

Let's just recall that by Murphy and Business for Scotland's own argument a population share of debt for Scotland in 1980 would be inappropriate, it would have to be higher to reflect our higher contribution to UK pre 1980s historic debt without oil revenue.

Were Scotland to turn up at the negotiating table with a proposal to pay anything less than a population share of debt based on these grounds they would be laughed out of the room, by simply extending (or shortening) the date of your starting position you massively increase Scotland's debt liability.

A case based on a one off starting date of a 5 year window in a 300 year history is not a case, it's just a meme for those who like to crowdfund from the needy.

Comments

Post a Comment