Are the SNP are taking a progressive approach to tax and public spending cuts

Increasingly you can hear the claim that the Scottish Government are being forced to impose cuts due to Westminster austerity. This is all about framing the progressive SNP against the austerity junkies in Westminster. Clearly the cuts to Scottish public spending are nothing to do with the SNP, as they can do no wrong, therefore these must be the result of evil Westminster.

So far so politics as usual. More importantly so far so old school devolution. But something has changed and few nationalists have caught up with it or updated their narrative and it would be a good idea to do so. The trouble is, updating that narrative would result in recognising that the SNP now have a direct hand in the cuts being "imposed" on the people of Scotland and they are getting increasingly uncomfortable about it.

Cuts to Scotland or the Scottish Government?

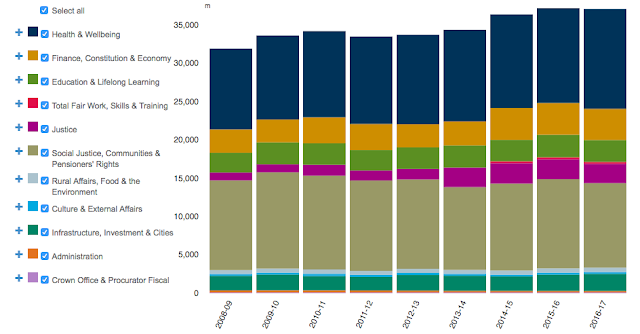

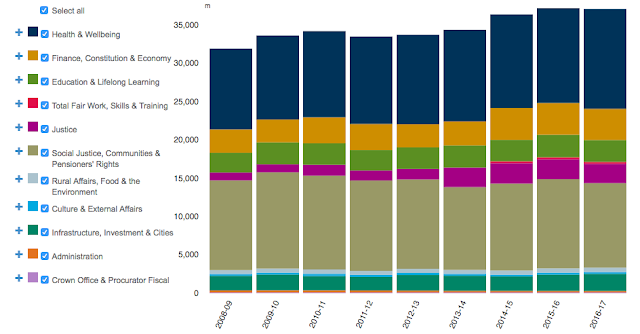

So let's start with some simple facts. There is no doubt that due to austerity and the Barnett consequentials of cuts in Westminster the Scottish Government are facing real terms cuts to their block grant.

However an often forgotten fact about Westminster public spending cuts is that they are also cutting taxes, specifically income tax through raising the personal allowance well above inflation. Therefore whilst the Scottish government is facing cuts the country a sa whole is facing far less substantial cuts. In practice then the changes in tax "imposed" by Westminster have shifted assets from the Scottish government to the Scottish people.

Of course that is no argument for a nationalist to stomach. Why shouldn't the Scottish Government decide how much tax the Scottish Government takes and how much is distributed in tax cuts to the rich? That's a perfectly rational democratic argument, although one that forgets about the benefits of an optimal and equalised taxation system in a single market as the Scottish Parliament recently recognised.

Even so it is perfectly rational point of view to argue that giving up optimal tax zones in the name of democracy is entirely reasonable, provided everyone was aware of the costs.

A masterful magician at work

And that's exactly where Scotland was this financial year with the launch of the Scottish Rate of Income Tax. This specifically enables the Scottish Government to stop the evil Westminster cutting funding for "vital" public services in favour of tax cuts for the Scottish people.

Therefore with the tools in hand to stop, or reduce austerity in public spending, the Scottish Government did... nothing. They went along with the current rate of income tax which passed on the increases in the personal allowance and cut tax bills for the people of Scotland.

Of course at this point Labour (the Red Tories) swooped in to argue that the SNP were rubber stamping austerity in Scotland. Rather than argue that the tax cuts that the SNP were pushing through were in the interests of the people of Scotland the party did some very fancy dealing arguing that an increase in income tax would hit the poorest hardest due to the effect of increasing tax bills by 5% for basic rate taxpayers.

There are many, many holes in this argument (which Kevin Hague has taken apart). Not least that the simultaneous effect of the substantially higher personal allowance meant that no one, let me say that again no one, would have seen their taxes increase by 5%. Indeed everyone below £20,000 a year would have seen their tax bills fall year on year even with a 1% increase in the rate of tax.

So the SNP managed to a brilliant sleight of hand. Putting through popular cuts to tax bills whilst blaming Westminster for the cuts to public spending. It was a masterful performance in electoral management.

Never do the same trick twice

Indeed this magic trick was so good the SNP were able to do it all over again despite a fundamental change in circumstances.

Whilst SRIT applies now, from next tax year the Scotland Bill 2016 kicks in and enables the Scottish Government to set tax rates and bands at any level it likes. The only restriction on the Scottish Government is that it cannot set the personal allowance lower than the UK rate (and it's unlikely that any government would dare to want or use that power).

This means that the fancy dealing of the SNP on the unfairness of SRIT was out the window. There would be nothing to stop the SNP setting taxes in a more progressive form and more importantly raising revenue to partially or fully remove the cuts to its budget and protect those "vital" public services.

So what did the SNP do when they set out their plans for the next 5 years? They decided that they would carry on cutting tax bills as they explained here.

But showing the confidence that only a master magician can display they used language which made it sound that they weren't actually cutting taxes but that they were increasing them.

The essence of the trick was that the SNP were not going to follow the UK when it came to increasing the 40% threshold for income tax. Instead they were going to push it up with inflation. This means that relative to the UK taxes for the rich were not falling as much in Scotland.

With skill, spin and often unquestioning loyalty this "not falling as much" has morphed into a tax increase in the minds of many supporters.

Behind the magician's curtain

But it's not an increase. The SNP plans are to cut tax and it's a series of cuts that benefit the wealthy most.

In essence the SNP plans are to increase the personal allowance from its current £11,000 to £12,750. They will also increase the 40% threshold by the rate of inflation.

In essence the SNP plans are to increase the personal allowance from its current £11,000 to £12,750. They will also increase the 40% threshold by the rate of inflation.

Of course they will also freeze the rate of income tax for 5 years (they can't very well change it after their SRIT rhetoric).

At first (and if you read the SNP rhetoric) you may conclude that increasing the personal allowance would benefit the poorest. After all it means more of them taken out of tax altogether. So far so reasonable. But it's only when you start to view the effects on higher incomes that you see what is really going on and that increasing the personal allowance alone is not as progressive as you might think.

People on higher incomes receive the same full benefit of not paying tax on more of their income, but crucially they also receive the benefits of the increases to the 40% threshold (which may not be increasing at the same rate as the rest of the UK but is still increasing nonetheless). Here I've assumed that they will increase to £43,387 next year and at the Bank of England target inflation rate of 2% for the remainder of the Parliament.

When you take all of this into account the effect is that someone on £25,000 benefits from a cash handout from the Scottish Government of £350 a year. Whilst someone on £100,000 would see a cash handout of £1,140 year. The effect reduces for someone on £150,000 as they do not receive a personal allowance but they still benefit more than twice as much as anyone paying basic rate tax.

That's not real magic!

There is nothing worse that when you work out how the magician has done the trick. It takes away the joy you felt when you watched them mesmerize you.

That's probably why this reveal, that the SNP are cutting tax bills for the rich and consequently causing unnecessary cuts to public spending, gets such a negative reaction from progressive SNP supporters (those that despise the Red Tories) which ranges from pure denial to rage.

Alternatively one could look at it the other way. The SNP are doing the right thing finding their usual populist balancing act between tax cuts (at a cost public spending cuts) but limiting the benefits of those cuts to the wealthiest. It's not progressive but it certainly does win elections in Scotland.

Perhaps the SNP know that, unlike the rhetoric, Scotland is much like the UK, public spending cuts can be stomached as long as there are tax cuts to sweeten the pill.

So let's start with some simple facts. There is no doubt that due to austerity and the Barnett consequentials of cuts in Westminster the Scottish Government are facing real terms cuts to their block grant.

However an often forgotten fact about Westminster public spending cuts is that they are also cutting taxes, specifically income tax through raising the personal allowance well above inflation. Therefore whilst the Scottish government is facing cuts the country a sa whole is facing far less substantial cuts. In practice then the changes in tax "imposed" by Westminster have shifted assets from the Scottish government to the Scottish people.

Of course that is no argument for a nationalist to stomach. Why shouldn't the Scottish Government decide how much tax the Scottish Government takes and how much is distributed in tax cuts to the rich? That's a perfectly rational democratic argument, although one that forgets about the benefits of an optimal and equalised taxation system in a single market as the Scottish Parliament recently recognised.

Even so it is perfectly rational point of view to argue that giving up optimal tax zones in the name of democracy is entirely reasonable, provided everyone was aware of the costs.

A masterful magician at work

And that's exactly where Scotland was this financial year with the launch of the Scottish Rate of Income Tax. This specifically enables the Scottish Government to stop the evil Westminster cutting funding for "vital" public services in favour of tax cuts for the Scottish people.

Therefore with the tools in hand to stop, or reduce austerity in public spending, the Scottish Government did... nothing. They went along with the current rate of income tax which passed on the increases in the personal allowance and cut tax bills for the people of Scotland.

Of course at this point Labour (the Red Tories) swooped in to argue that the SNP were rubber stamping austerity in Scotland. Rather than argue that the tax cuts that the SNP were pushing through were in the interests of the people of Scotland the party did some very fancy dealing arguing that an increase in income tax would hit the poorest hardest due to the effect of increasing tax bills by 5% for basic rate taxpayers.

There are many, many holes in this argument (which Kevin Hague has taken apart). Not least that the simultaneous effect of the substantially higher personal allowance meant that no one, let me say that again no one, would have seen their taxes increase by 5%. Indeed everyone below £20,000 a year would have seen their tax bills fall year on year even with a 1% increase in the rate of tax.

So the SNP managed to a brilliant sleight of hand. Putting through popular cuts to tax bills whilst blaming Westminster for the cuts to public spending. It was a masterful performance in electoral management.

Never do the same trick twice

Indeed this magic trick was so good the SNP were able to do it all over again despite a fundamental change in circumstances.

Whilst SRIT applies now, from next tax year the Scotland Bill 2016 kicks in and enables the Scottish Government to set tax rates and bands at any level it likes. The only restriction on the Scottish Government is that it cannot set the personal allowance lower than the UK rate (and it's unlikely that any government would dare to want or use that power).

This means that the fancy dealing of the SNP on the unfairness of SRIT was out the window. There would be nothing to stop the SNP setting taxes in a more progressive form and more importantly raising revenue to partially or fully remove the cuts to its budget and protect those "vital" public services.

So what did the SNP do when they set out their plans for the next 5 years? They decided that they would carry on cutting tax bills as they explained here.

But showing the confidence that only a master magician can display they used language which made it sound that they weren't actually cutting taxes but that they were increasing them.

The essence of the trick was that the SNP were not going to follow the UK when it came to increasing the 40% threshold for income tax. Instead they were going to push it up with inflation. This means that relative to the UK taxes for the rich were not falling as much in Scotland.

With skill, spin and often unquestioning loyalty this "not falling as much" has morphed into a tax increase in the minds of many supporters.

Behind the magician's curtain

But it's not an increase. The SNP plans are to cut tax and it's a series of cuts that benefit the wealthy most.

In essence the SNP plans are to increase the personal allowance from its current £11,000 to £12,750. They will also increase the 40% threshold by the rate of inflation.

In essence the SNP plans are to increase the personal allowance from its current £11,000 to £12,750. They will also increase the 40% threshold by the rate of inflation. Of course they will also freeze the rate of income tax for 5 years (they can't very well change it after their SRIT rhetoric).

At first (and if you read the SNP rhetoric) you may conclude that increasing the personal allowance would benefit the poorest. After all it means more of them taken out of tax altogether. So far so reasonable. But it's only when you start to view the effects on higher incomes that you see what is really going on and that increasing the personal allowance alone is not as progressive as you might think.

People on higher incomes receive the same full benefit of not paying tax on more of their income, but crucially they also receive the benefits of the increases to the 40% threshold (which may not be increasing at the same rate as the rest of the UK but is still increasing nonetheless). Here I've assumed that they will increase to £43,387 next year and at the Bank of England target inflation rate of 2% for the remainder of the Parliament.

When you take all of this into account the effect is that someone on £25,000 benefits from a cash handout from the Scottish Government of £350 a year. Whilst someone on £100,000 would see a cash handout of £1,140 year. The effect reduces for someone on £150,000 as they do not receive a personal allowance but they still benefit more than twice as much as anyone paying basic rate tax.

That's not real magic!

There is nothing worse that when you work out how the magician has done the trick. It takes away the joy you felt when you watched them mesmerize you.

That's probably why this reveal, that the SNP are cutting tax bills for the rich and consequently causing unnecessary cuts to public spending, gets such a negative reaction from progressive SNP supporters (those that despise the Red Tories) which ranges from pure denial to rage.

Alternatively one could look at it the other way. The SNP are doing the right thing finding their usual populist balancing act between tax cuts (at a cost public spending cuts) but limiting the benefits of those cuts to the wealthiest. It's not progressive but it certainly does win elections in Scotland.

Perhaps the SNP know that, unlike the rhetoric, Scotland is much like the UK, public spending cuts can be stomached as long as there are tax cuts to sweeten the pill.

I guess a lot of the snp voters like myself are well below the minimum so it does benefit us

ReplyDeleteNo one is suggesting that lower paid people are not benefiting. The point is Ellen that others are benefitting to a far greater extent. Hence tax cuts skewed to the rich.

ReplyDeleteLike the council tax freeze they bribe the wealthy and ultimately the poor suffer !

ReplyDelete