The ex-pat fallacy

TL:DR

It's a logical fallacy to say that post independence Scottish residents will be ex-pats of rUK regards pensions.

- Ex-pats can vote in rUK, Scottish residents cannot

- Carving out the split of pension obligations between iScotland and rUK would be relatively simple and would not endager existing ex-pat pensions.

- Nationalists can't answer why they think 91% of the former UK gets stuck with 100% of its pension liabilities.

The killer augment runs thus:

If I move to Spain then the UK pays my pension, so Scots after independence will be in the same category and the rUK will pay my pension. If rUK decided not to pay pensions to Scots it would have to stop all ex-pat pensions and that would also be illegal.

It’s a false argument.

Why have ex-pat pensions

It’s probably best to start with some basics. Why have ex-pat pensions at all?

The current position is that anyone working in the UK and paying national insurance earns credits towards a state pension from the UK. Those credits are non contractual and non enforceable intentions by the UK state to pay a pension in the future. I can’t stress enough that these aren’t enforceable rights by prospective pensioners as the UK state (or any state) can vary who to pay pensions to or how much to pay whenever they like.

If these were legally enforceable rights then there wouldn’t be a WASPI issue, nor would the UK be able to ay lower pensions to certain ex-pats depending on the country that they moved to.

This system gives a pseudo pension scheme "feel" to the pension welfare benefit and much of that is intentional to ensure better take up rate and have recipients feel that they are entitled to the benefit no matter what their income position,.

So why pay anything at all to ex-pats, these are people that have left the country after all, why pay them anything?

It’s simple: think of the alternative.

If you don’t pay anything to ex-pats then what are the qualification criteria for a pension? You are no longer earning credits for a pension: it’s paid entirely conditionally based on where you live. So surely that would mean that it switches from a credit based system to a residency benefit, like child benefit. That’s a potential problem for the UK if that happens.

If the state pension switched to a straight residency based benefit then anyone settling in the UK would be entitled to a full state pension by right of residency, regardless of where they served their working years, thats potentially very expensive.

Ex-pat pensions then are a method of the UK being able to maintain that the state pension is not a universal benefit but one that is subject to a range of conditions which include the earning of credits (so paying tax in the past) current point of residency. Having reciprocal agreements with other states means that every nation is better able to manage its pensions liabilities rather than become an attractive state for retirees from around the world.

With all that in mind let’s now break down the ex-pat fallacy.

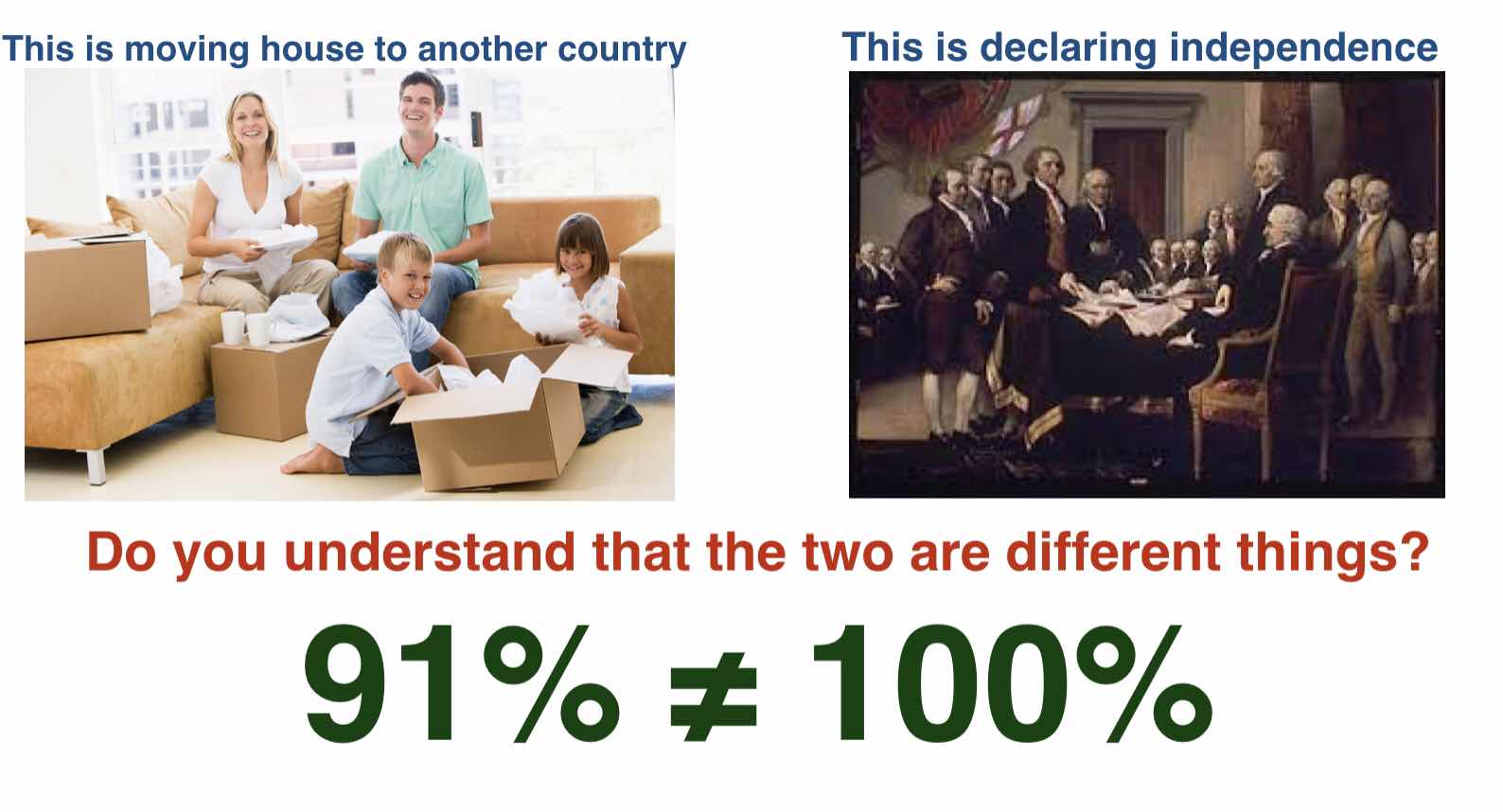

Independence is not moving house

The most obvious error is that independence is not moving to another country. It’s not analogous to it nor is it in no way legally the same. For example moving to another country doesn’t mean you lose your voting rights in the UK (ex-pats can still vote). Are we therefore to believe that after independence Scots will still be able to vote in rUK elections?

I know that sounds absurd, but if it does then you should realise that is exactly the same argument you are applying to say that independence is the same as becoming an ex-pat.

All ex-pat pensions would have to stop

This is a bizarre hail mary of an assertion thrown in by Campbell in one of his hilariously inaccurate pensions rants. The line being if rUK stopped paying pensions to Scottish residents after independence then rUK would also have to stop paying pensions to all ex-pats throughout the world no matter where they are from.

You can destroy that argument with one word; why.

None of it makes any sense when you think about it for a moment, not paying pensions to Scottish residents would not endanger current ex-pats, why would it? It’s not as if Scottish residents post independence are ex-pats (see above), nor would it be fiendishly difficult to come up with a form or words for eligibility to an rUK state pension.

If the current (simplified) from of eligibility was as follows:

UK state pensions are paid to anyone who has earned qualifying credits, pensions are paid in proportion to those credits and will be uprated every year if they live in the UK or any territory with which UK has a reciprocal agreement. Where residency is in a country without a reciprocal agreement then the level of state pension will not be uprated.

Then the updated version for rUK would be:

rUK state pensions are paid to anyone who was not a resident or ex-pat of Scotland on [independence date] who has earned qualifying credits, pensions are paid in proportion to those credits and will be uprated every year if they live in the rUK or any territory with which rUK has a reciprocal agreement. Where residency is in a country without a reciprocal agreement then the level of state pension will not be uprated.

Similarly I would expect an independent Scotland to have something similar:

Scottish state pensions are paid to anyone who was a resident or ex-pat of Scotland on [independence date] who has earned qualifying credits under the former UK scheme or Scottish state pension scheme, pensions are paid in proportion to those credits and will be uprated every year if they live in Scotland or any territory with which Scotland has a reciprocal agreement. Where residency is in a country without a reciprocal agreement then the level of state pension will not be uprated.

There is nothing complicated here, it’s just what any pension planner would do on the normal splitting of a scheme, the liabilities are carved up between the two parties in a manner that is fair. The residency clause suggestion Ive used here comes directly from the SNP’s white paper during the indyref.

For anyone desperately trying to find a way out of this along the lines of this being discrimination then you are on a highway to nothing. We already differentiate pensions based on residency: just ask an ex-pat in South Africa or New Zealand and this has been confirmed by the ECHR as entirely a matter for Parliament.

Let me just say it again it has been confirmed in international law that rUK can pay whatever the hell it likes in pensions to whomever provided it has the blessing of its Parliament.

The rUK and UK fallacy

The ex-pat fallacy is just a derivative of the rUK/UK fallacy that nationalists just can’t seem to get their heads around.

Even if you accept their position that the UK pension is actually some sort of legally enforceable contract (a position that has no legal backing whatsoever) then that creates a whole new problem for them that they just haven’t thought through.

If this mythical pension scheme existed then it’s a UK scheme.

The ex-pat fallacy

A number of nationalists seem to think that they have a killer argument to the jointly confirmed position that after independence all Scottish pensions (including those in payment) will become the responsibility of the Scottish Government.

This all arises from desperate attempts to protect the fundamental fact that many nationalists lied about pensions during the independence referendum, they are then forced to continue arguing that rUK is legally obliged to pay pensions to Scots after independence. They aren’t legally obliged to pay anything as confirmed by the ECHR on numerous occasions.

This all arises from desperate attempts to protect the fundamental fact that many nationalists lied about pensions during the independence referendum, they are then forced to continue arguing that rUK is legally obliged to pay pensions to Scots after independence. They aren’t legally obliged to pay anything as confirmed by the ECHR on numerous occasions.

The killer augment runs thus:

If I move to Spain then the UK pays my pension, so Scots after independence will be in the same category and the rUK will pay my pension. If rUK decided not to pay pensions to Scots it would have to stop all ex-pat pensions and that would also be illegal.

It’s a false argument.

Firstly the Social Security Contributions and Benefits Act 1992 is very clear on the legal obligation to obtain a state pension when you move out of the UK:

"Except where regulations otherwise provide, a person shall be disqualified for receiving any benefit (references including state pensions)... for any period during which the person—

(a )is absent from Great Britain"

So the policy of paying state pensions to ex-pats is at the discretion of the UK Government in secondary legislation and even if state pensions were a legal right that right would end when someone leaves the UK.

So if the UK doesn't need to have ex-pat pensions why have them at all?

Why have ex-pat pensions

It’s probably best to start with some basics. Why have ex-pat pensions at all?

The current position is that anyone working in the UK and paying national insurance earns credits towards a state pension from the UK. Those credits are non contractual and non enforceable intentions by the UK state to pay a pension in the future. I can’t stress enough that these aren’t enforceable rights by prospective pensioners as the UK state (or any state) can vary who to pay pensions to or how much to pay whenever they like.

If these were legally enforceable rights then there wouldn’t be a WASPI issue, nor would the UK be able to ay lower pensions to certain ex-pats depending on the country that they moved to.

This system gives a pseudo pension scheme "feel" to the pension welfare benefit and much of that is intentional to ensure better take up rate and have recipients feel that they are entitled to the benefit no matter what their income position,.

So why pay anything at all to ex-pats, these are people that have left the country after all, why pay them anything?

It’s simple: think of the alternative.

If you don’t pay anything to ex-pats then what are the qualification criteria for a pension? You are no longer earning credits for a pension: it’s paid entirely conditionally based on where you live. So surely that would mean that it switches from a credit based system to a residency benefit, like child benefit. That’s a potential problem for the UK if that happens.

If the state pension switched to a straight residency based benefit then anyone settling in the UK would be entitled to a full state pension by right of residency, regardless of where they served their working years, thats potentially very expensive.

Ex-pat pensions then are a method of the UK being able to maintain that the state pension is not a universal benefit but one that is subject to a range of conditions which include the earning of credits (so paying tax in the past) current point of residency. Having reciprocal agreements with other states means that every nation is better able to manage its pensions liabilities rather than become an attractive state for retirees from around the world.

With all that in mind let’s now break down the ex-pat fallacy.

Independence is not moving house

The most obvious error is that independence is not moving to another country. It’s not analogous to it nor is it in no way legally the same. For example moving to another country doesn’t mean you lose your voting rights in the UK (ex-pats can still vote). Are we therefore to believe that after independence Scots will still be able to vote in rUK elections?

I know that sounds absurd, but if it does then you should realise that is exactly the same argument you are applying to say that independence is the same as becoming an ex-pat.

All ex-pat pensions would have to stop

This is a bizarre hail mary of an assertion thrown in by Campbell in one of his hilariously inaccurate pensions rants. The line being if rUK stopped paying pensions to Scottish residents after independence then rUK would also have to stop paying pensions to all ex-pats throughout the world no matter where they are from.

You can destroy that argument with one word; why.

None of it makes any sense when you think about it for a moment, not paying pensions to Scottish residents would not endanger current ex-pats, why would it? It’s not as if Scottish residents post independence are ex-pats (see above), nor would it be fiendishly difficult to come up with a form or words for eligibility to an rUK state pension.

If the current (simplified) from of eligibility was as follows:

UK state pensions are paid to anyone who has earned qualifying credits, pensions are paid in proportion to those credits and will be uprated every year if they live in the UK or any territory with which UK has a reciprocal agreement. Where residency is in a country without a reciprocal agreement then the level of state pension will not be uprated.

Then the updated version for rUK would be:

rUK state pensions are paid to anyone who was not a resident or ex-pat of Scotland on [independence date] who has earned qualifying credits, pensions are paid in proportion to those credits and will be uprated every year if they live in the rUK or any territory with which rUK has a reciprocal agreement. Where residency is in a country without a reciprocal agreement then the level of state pension will not be uprated.

Similarly I would expect an independent Scotland to have something similar:

Scottish state pensions are paid to anyone who was a resident or ex-pat of Scotland on [independence date] who has earned qualifying credits under the former UK scheme or Scottish state pension scheme, pensions are paid in proportion to those credits and will be uprated every year if they live in Scotland or any territory with which Scotland has a reciprocal agreement. Where residency is in a country without a reciprocal agreement then the level of state pension will not be uprated.

There is nothing complicated here, it’s just what any pension planner would do on the normal splitting of a scheme, the liabilities are carved up between the two parties in a manner that is fair. The residency clause suggestion Ive used here comes directly from the SNP’s white paper during the indyref.

For anyone desperately trying to find a way out of this along the lines of this being discrimination then you are on a highway to nothing. We already differentiate pensions based on residency: just ask an ex-pat in South Africa or New Zealand and this has been confirmed by the ECHR as entirely a matter for Parliament.

Let me just say it again it has been confirmed in international law that rUK can pay whatever the hell it likes in pensions to whomever provided it has the blessing of its Parliament.

The rUK and UK fallacy

The ex-pat fallacy is just a derivative of the rUK/UK fallacy that nationalists just can’t seem to get their heads around.

Even if you accept their position that the UK pension is actually some sort of legally enforceable contract (a position that has no legal backing whatsoever) then that creates a whole new problem for them that they just haven’t thought through.

If this mythical pension scheme existed then it’s a UK scheme.

A UK scheme made up of what will be rUK and iScot.

Both parties have benefitted from this scheme having paid in over the years and receiving benefits out of it. Furthermore the iScottish element of the UK has benefitted more on a population share basis given by the fact our NI contributions lag that of rUK but our payouts from the scheme are at least as high as rUK on a proportionate basis.

The nationalist angle in all this seems to be post independence 100% of the liabilities for the scheme will go to 91% of the former scheme (rUK) and 9% of the former scheme will get 0% of the liabilities.

You then ask why?

You get some wailing strawmen about successor state (doesn’t apply as it’s not state debt) or something about the SNP not being in control of pensions (doesn’t apply as its not as if Scotland rejected en masse receiving pensions from WM).

The reason you get the screaming level of non responses to people applying the ex-pat fallacy is that they just haven’t thought it through. When you do follow the logic it all collapses within a few seconds.

Ex-pats post independence

I genuinely think that post independence existing UK ex-pats (whether originally from Scotland, rUK or anywhere else) would be relatively secure. They will continue to be serviced by the UK International Pension Service into which the Scottish Government will be required to pay a population share of the costs of such pensions.

The nationalist angle in all this seems to be post independence 100% of the liabilities for the scheme will go to 91% of the former scheme (rUK) and 9% of the former scheme will get 0% of the liabilities.

You then ask why?

You get some wailing strawmen about successor state (doesn’t apply as it’s not state debt) or something about the SNP not being in control of pensions (doesn’t apply as its not as if Scotland rejected en masse receiving pensions from WM).

The reason you get the screaming level of non responses to people applying the ex-pat fallacy is that they just haven’t thought it through. When you do follow the logic it all collapses within a few seconds.

Ex-pats post independence

I genuinely think that post independence existing UK ex-pats (whether originally from Scotland, rUK or anywhere else) would be relatively secure. They will continue to be serviced by the UK International Pension Service into which the Scottish Government will be required to pay a population share of the costs of such pensions.

That would be a simple way to run off the legacy ex-pat book of the UK scheme. At the same time Scotland and rUK would either set up their own separate systems for ex-pats or continue to cooperate on maintaining a joint IPS.

But again an ex-pat of rUK is not a Scottish resident at the time of independence. They are an entirely different category of pensioners and they will be due a pension in whatever form, value and currency the Scottish Government decides.

But again an ex-pat of rUK is not a Scottish resident at the time of independence. They are an entirely different category of pensioners and they will be due a pension in whatever form, value and currency the Scottish Government decides.

Finally it's a bit of a test for anyone citing this blog and then claiming that it's wrong because ex-pat is the wrong term. Well you have a point because the case here could also be foreign nationals who also get pensions when they return home, or just leave for another country to retire. Ex-pat just runs off the tongue and is very much a metaphor or catchall for all such cases of paying pensions to people not in the UK.

So if you are claiming that this blog is wrong because I've used the term ex-pat then you clearly haven't read to the end.

CBP - 7894 Brexit and State Pensions

ReplyDeleteExtract from above:

The arrangements to apply in future have been part of the negotiations under Article 50 on the UK’s withdrawal from the EU. A joint report on progress published on 8 December 2017 said that, with the caveat that “nothing is agreed until everything is agreed”, the Withdrawal Agreement would include a commitment to social security co-ordination:

28. Social security coordination rules set out in Regulations (EC) No 883/2004 and (EC) No 987/2009 will apply. Social security coordination rules will cover Union citizens who on the specified date are or have been subject to UK legislation and UK nationals who are or have been subject to the legislation of an EU27 Member State, and EU27 and UK nationals within the scope of the Withdrawal Agreement by virtue of residence. Those rules will also apply, for the purposes of aggregation of periods of social security insurance, to Union and UK citizens having worked or resided in the UK or in an EU27 Member State in the past.

"The nothing is agreed until everything is agreed" creates the Rumsfeld situation where there are very considerable known unknowns. These will and must remain until we know the outcome of the Brexit negotiations, and whatever that outcome it will probably range both wider and indeed longer than those who engage on the issue within the sole context of the independence debate. Brexit is the joker in the pack - the wild card, yet to be played.